How much can i borrow with a fha loan

Take the First Step Towards Your Dream Home See If You Qualify. Mortgage Calculator This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income.

Fha Loan Requirements And Guidelines

This mortgage calculator will show how much you can afford.

. There are multiple factors that can affect the loan amount. Apply for Your Mortgage Now. It also gives you an estimate of your monthly payments and.

FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases. You can borrow as much as your local FHA loan limit but no more than that. 4 rows In low-cost markets the FHA loan limit is 65 of the conforming loan limit in the county.

Fill in the entry fields. The amount of money you spend upfront to purchase a home. Ad Find How Much Mortgage Can You Qualify For.

7 rows An FHA loan is a government-backed conforming loan insured by the Federal Housing. You need to make 138431 a year to afford a 450k mortgage. A general rule is that these items should not exceed 28 of the borrowers gross income.

To calculate how much you can borrow for a mortgage youll need to consider your income debts and the type of loan youre interested in. Our mortgage qualification calculator can help you find out how much you can qualify to borrow. In most parts of the country the limit is currently set at 625500.

Bank Offers Competitive Mortgage Rates Fees and Exceptional Customer Service. Apply Get Pre Approved. With Low Down Payment Low Rates An FHA Loan Can Save You Money.

What is the maximum amount you can borrow for an FHA loan. How much can you. Ad First Time Homebuyers.

A mortgage loan calculator helps you determine how much you can afford to borrow for your home purchase. Calculate what you can afford and more. Ad Realize Your Dream of Having Your Own Home.

However some lenders allow the borrower to exceed 30 and some even allow 40. Generally the most you can borrow with an FHA loan is 420680. In general according to the FHA loan handbook HUD 40001 A Mortgage that is to be insured by FHA cannot.

That applies to single-family homes with limits. If you make 3000 a month your DTI with an FHA loan should be no more than 1290 â which means you can afford a house with a monthly payment that is no more than. Other loan programs are.

Check Your Official Eligibility Today. The MIP displayed are based upon FHA guidelines. The 2022 FHA loan limits for single-family homes reflect an 18.

At 60000 thats a 120000 to 150000 mortgage. Todays 10 Best FHA Loans Comparison. See how much you can.

How much can i borrow ona fha loan by Selina Beahan V Published 1 year ago Updated 4 weeks ago The FHA loan limit floor is 65 of the conforming loan limit or 420680 for most. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. The FHA loan max or ceiling in high-cost areas is 970800 this is 150 of the conforming loan limit.

Lock Rates For 90 Days While You Research. A 20 down payment is ideal to lower your monthly payment avoid. Compare Rates of Interest Down Payment Needed in Seconds.

View Ratings of the Best Mortgage Lenders. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. Most home loans require a down payment of at least 3.

A minimum of 5000 must be borrowed and maximum limits are set by the FHA that. With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000. Apply Get Pre-Approved In Minutes.

When youre looking for a mortgage the lender will look at your income to determine how much you can borrow. Take the First Step Towards Your Dream Home See If You Qualify. Ad No Income Limits Flexible Credit Guidelines Help Make Qualifying For An FHA Loan Easier.

Ad Updated FHA Loan Requirements for 2022. Dont Settle Save By Choosing The Lowest Rate. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

FHA loan funds are transferred into an escrow account and paid to contractors as improvements occur. Check Your Official Eligibility Today. Ad We Offer Competitive RatesFees Online Conveniences - Start Today.

If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Loan to Value LTV This is the amount of the mortgage expressed as a percentage of the property value. The first step in buying a house is determining your budget.

FHA loan rules require a minimum 35 down payment so you can approximate how much money down you will need by doing the math based on the maximum loan amount. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. How Much Can I Borrow.

Ad Updated FHA Loan Requirements for 2022. Start Your Homebuying Journey Today. Ultimately your maximum mortgage.

Borrowers can exceed this. This mortgage calculator will show how much you can afford. Ad Find FHA Loan Rates Terms That Fit Your Needs.

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

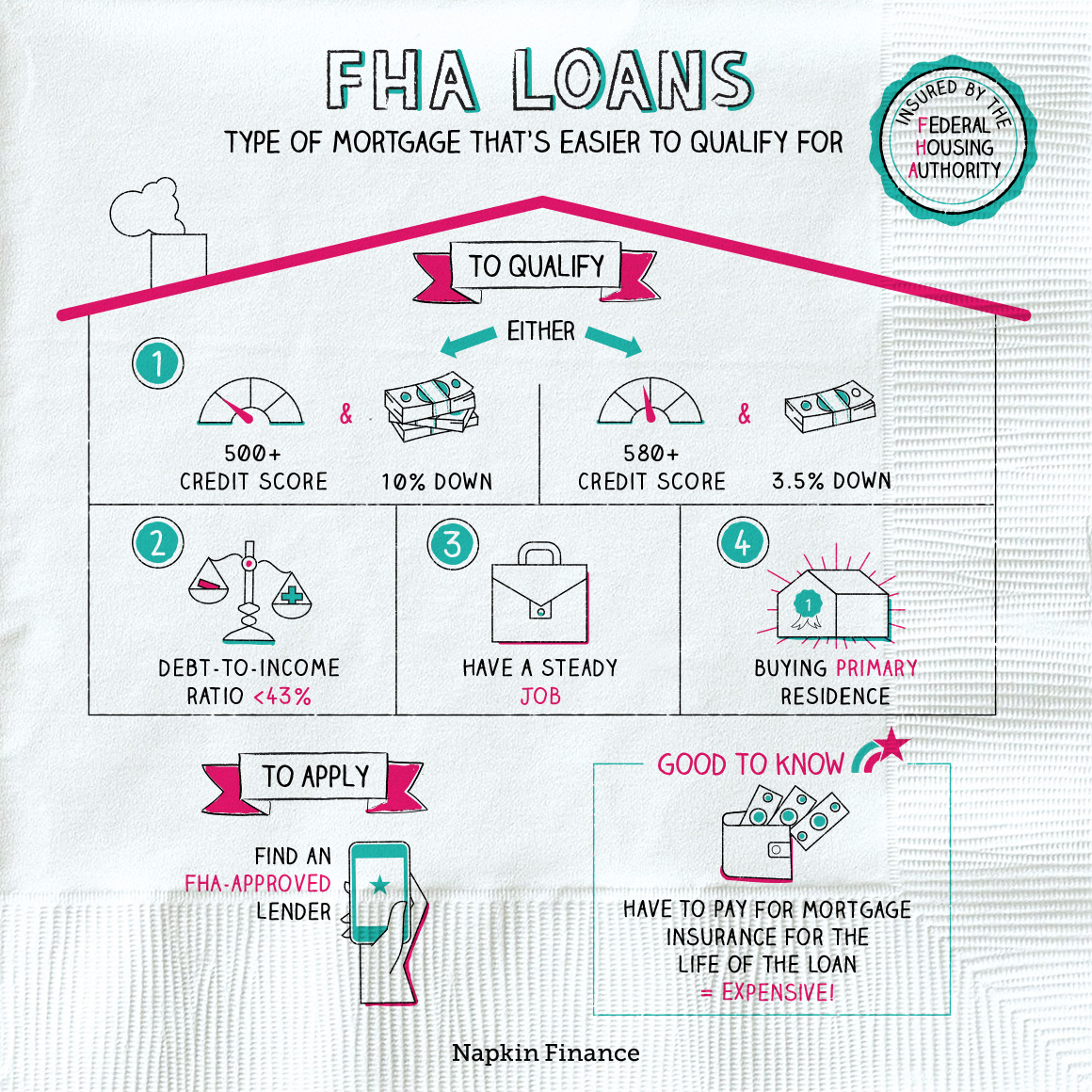

Fha Loans Napkin Finance

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Benefits Of Fha Loan Phoenix Az Real Estate And Homes For Sale

Fha Loans Everything You Need To Know

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Is An Fha Loan Good For You Stem Lending

Fha Loans Your Complete Guide Loanry

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Fha Loan Down Payment Requirements For 2021

Fha Loan Requirements Rates California 3 5 Down Payment E Zip Mortgage

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Let S Talk Loan Options Fha Loan Total Mortgage Blog

Fha Loan What To Know Nerdwallet